By Vincent Barbera, CFP®, MSFS

Kids cost a lot of money. Between putting a roof over their head, feeding their growing appetites, paying for braces, and everything else that goes along with raising a child, you could be looking at a half-million-dollar bill over a couple of decades. (1) After paying for all of the basic needs, it may seem impossible to think about putting money aside for college too.

As tempting as it is to put saving for college on the back burner, you don’t want to get caught unaware and unprepared for college. Your child’s education is one of the most important investments you can make, and with today’s costs, it pays to plan ahead. As we approach National 529 College Savings Plan Awareness Day, it’s a good time to ask yourself this question: Have you started saving for your child’s future education costs? If not, here are 5 ways to get started.

1. Estimate The Cost

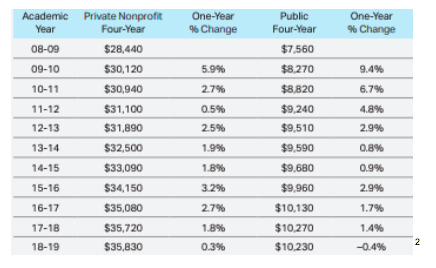

College tuition gets more expensive every year, and the numbers can cause anyone to break out in a sweat. Tuition rates have increased at a faster pace than many other expenses over the past decade, and it doesn’t look like they will slow down anytime soon. In the past 10 years, college costs have risen an average of 2.4% a year for private schools and 3.5% for public colleges.

The following table shows the average cost for one year of tuition (not including other educational expenses).

Even though the drastic hikes tapered off this past year, if the upward trend continues, in 25 years it could cost $300,000 to obtain a four-year undergraduate degree. The costs will vary depending on the institution attended, room and board, and other educational expenses, but either way, that’s a pretty penny for four years of school. For a 2018 graduate, the average student loan balance was $29,800 and the average monthly student loan payment is $393. (3) For students just beginning their careers, that’s a hefty bill to pay. The substantial cost may seem overwhelming, but knowing what to expect gives you a goal to aim for.

2. Save Early And Often

It’s never too late or too early to start saving for your child’s college fund. By starting early, you can reap the rewards of compound interest. (4) If you wait, your account balance may not be as high, but you are still investing something toward your child’s future.

Even if you don’t think you have enough room in your budget to add another line item, $25 a month is still $25 more than $0. Setting up automatic contributions is a good way to remind yourself that college is getting closer, and your monthly account statement will keep this goal in the forefront of your mind. You can also make it a goal to save extra money from a raise or a bonus and invest it in your child’s future.

3. Decide How To Save

The most common method people use to save for college is through a 529 plan. A 529 plan is a state-sponsored education savings account that allows earnings to grow on a tax-deferred status. There are two categories of 529 plans: prepaid tuition plans and college savings plans.

Prepaid plans let you pay future tuition costs at today’s prices, which, considering skyrocketing college costs, can be enticing. On the other hand, college savings plans have no age or income restrictions and allow you to save up to $300,000 per child in many state programs, and then use it, tax-free, for qualified education expenses. As an added benefit, you are not limited to using the plan offered by the state you live in. Some states will give you a tax credit for using their plan, but in many cases, it’s worth it to shop around.

Beyond 529 plans, some families use Roth IRAs. Your Roth contributions can be withdrawn at any time and can be used for any purpose. In addition, Roth IRAs offer virtually unlimited investment options. Lastly, IRAs will not have any impact on your financial aid eligibility.

For college savings, Roth IRAs aren’t the perfect option, but they do offer an alternative to the traditional 529 plans. Think about opening a 529 plan for college but also continuing to contribute to a Roth for retirement. This strategy gives you extra resources to draw on if you need them.

4. Divide The Cost Into Thirds

While some people are able to save and pay for the total cost of their child’s college education, most people don’t fit into this category. Instead of letting that fact get you down, break the cost of college into thirds.

The first step is to save before your children head off to college. By starting early and having some help from the markets, you can accumulate a solid base to use for tuition as well as room and board. The next step is to plan on paying for about one-third of the costs while your child is in college. This can be through a combination of scholarships, grants, a part-time job for your child, or contributions from the family. The final piece is student loans that your child or you can repay after they have completed their education. Since the goal would be to minimize student loans, try to maximize the first two parts of this three-pronged strategy first.

5. Keep An Eye On Your Investments

Just like your 401(k) plan, you need to monitor your college planning investments. In the early days of saving for college, you will want to be more aggressive with your investments, but as college draws closer, the investment allocation should become more conservative, just like a retirement account. Some 529 plans even offer age-based investment options that automatically become more conservative as your child gets older. It is also helpful to monitor your balances, keep an eye on the changing college costs, and track your progress toward your goal.

We Can Help You Get Started

If you are ready to start saving for college, Newbridge Wealth Management can help. We offer college funding strategies and expected family contribution (EFC) review so you can prepare both yourself and your child for the future. With our guidance, you can start saving for your child’s future today so you can ease the worries of tomorrow. To get started, schedule a free 15-minute introductory phone call online or reach out to us at vincent@newbridgewealth.com or 610.727.3960.

About Vincent

Vincent R. Barbera, CFP®, MSFS is a managing partner and co-founder of Newbridge Wealth Management, a private financial counseling firm located in Berwyn, Pennsylvania. Believing in a patient, disciplined approach to investment management that delivers value and peace of mind, he utilizes a process-driven approach to financial planning that provides comfort and clarity to his clients’ long-term goals. Along with a bachelor’s degree in psychology and business, he has a master’s degree in business and financial planning and Certified Financial Planner™ designation. Learn more by connecting with Vincent on LinkedIn, or send him questions at vincent@newbridgewealth.com.

_________

(2) https://trends.collegeboard.org/sites/default/files/2018-trends-in-college-pricing.pdf

(3) https://studentloanhero.com/student-loan-debt-statistics/

(4) http://www.businessinsider.com/amazing-power-of-compound-interest-2014-7