A Modern-day miracle: The Fed is correct. The inflation spike will be “transitory.”

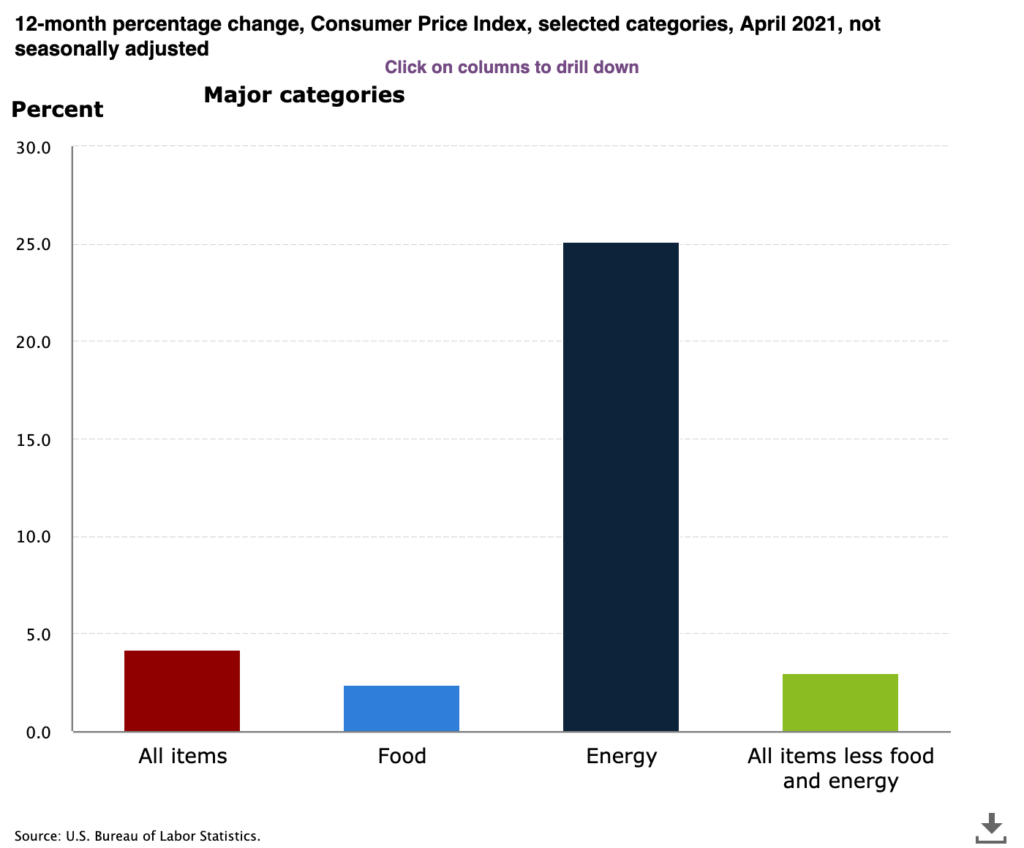

The rate of inflation surprised the markets recently by coming in hot – it was +4.2% over the last 12 months. Core inflation – inflation on everything other than food and energy – was +3.0%. That was the biggest increase since January ’96.

Since inflation is a key determinant of long-term interest rates, long rates rose in response to this news. That tripped up stocks. It was a sea of red, but it will not last. At least not the inflation part. The Fed is wrong on just about everything. This time they are correct. Inflation is unlikely to be a structural problem (for now).

Here are some reasons:

Reason #1:

As we all know, the pandemic caused some serious disruptions to the transport of goods across the globe. It is still playing out. Just yesterday I received an Etsy order that was 5 months old! A year ago, ports weren’t allowing ships to dock. The oil market blew up like never before, sending futures prices to negative values. Shipping companies had to pay to offload their freight (as opposed to getting paid!). That craziness has normalized over the past year. The winners have gained pricing power that has manifest in higher prices today. It will continue for a bit, but competition will nullify this phenomenon going forward.

Reason #2:

At the end of 2020, gross U.S. government debt reached a record of 129.1% of GDP. Records were set in Europe, Japan, and China too. Research indicates that government debt starts to have a negative impact on real GDP when it eclipses 50% of GDP. That threshold has been in our rearview mirror for a long time. The implication is borne out in the data. Since the late 90’s our real GDP growth has been about 45% per annum less than the rest of the 20th century. The pandemic has only exacerbated this problem, of course. With ever-increasing resources devoted to the service of debt, there is a force of disinflation in the air. Not inflation.

Reason #3:

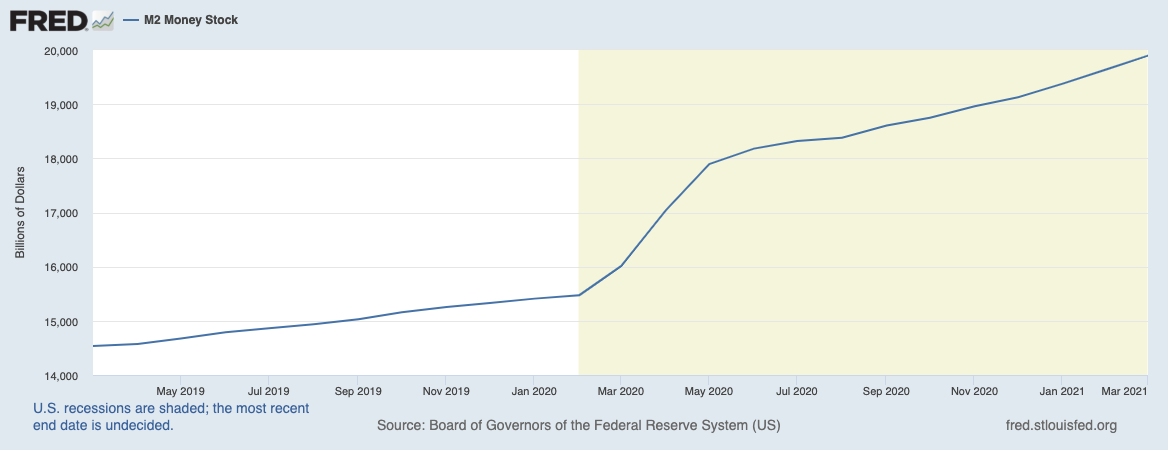

Monetary policy continues to push on a string. As you know, the Fed once again fired another bazooka in response to something bad happening. They started buying anything they could get their hands on, including corporate bond ETFs this time around. But what is the real economic impact? The net effect of quantitative easing is nothing more than an addition to bank reserves. M2 – the measure of money supply that includes cash, checking deposits, and easily convertible near money – increased nearly 20% last year. That is the most since WW2.

But it just sits there.

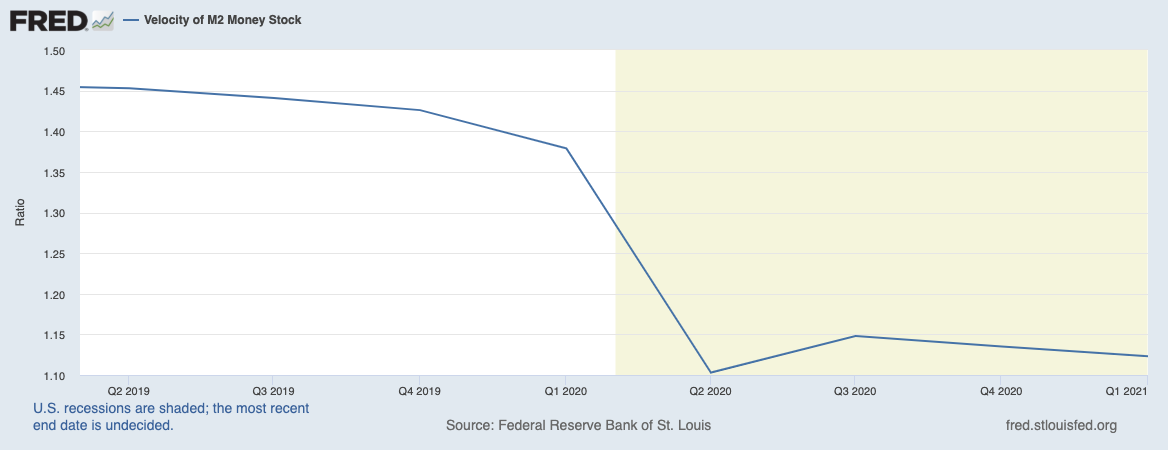

Banks aren’t lending it out to enterprises for productive use. No! Why would they if they cannot get the risk premia in the lending rate? If the money were being circulated through the economy for real stimulus, the velocity of money would not have plummeted in direct correlation to the QE (1.42 pre-pandemic to 1.10). This is not a story of inflation.

Inflation is a lagging indicator. Is it any wonder prices would be higher today than when the entire country was shut down? The markets will eventually wise up. The real problem we have is an addiction to stimulus. As it fades the onus is on the enterprise to at least replace the retracement of government spending. It remains to be seen if this will take place.