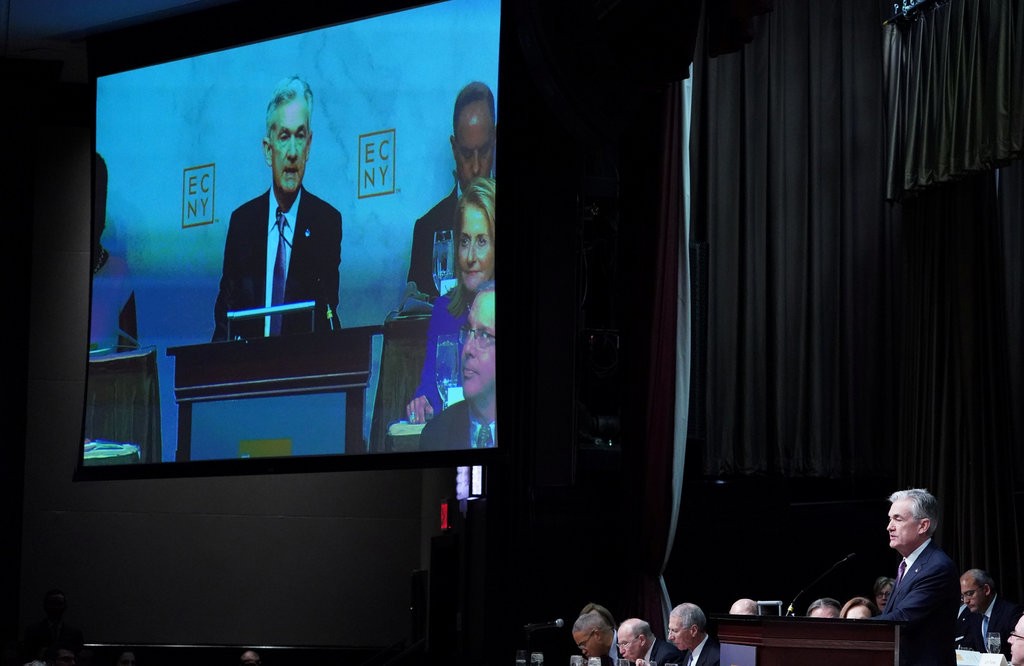

Photo Credit: New York Times

The modern era of experimental monetary policy intervention took another bizarre turn Wednesday at The Economic Club of New York. In a speech, Chairman Jerome Powell said three things which sent capital markets into a frenzy.

First, he said that his rate — the Federal Funds Rate — was “close” to the lower band of a normal level. Back in October, he said it was a “long way” from that level, so this wordsmithing was considered a dramatic departure in stance. Market Interpretation: We might be near the end of Fed “tightening,” meaning the short-term interest rates influenced by this effort may stop rising. So in response, those rates dropped significantly Wednesday, the dollar went down/gold went up, and stocks jumped higher because that is what they do any time the Fed even hints at easing up.

“Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy‑‑that is, neither speeding up nor slowing down growth.”

Second, and most importantly in our view, he unlawfully declared there is a third objective to Fed policy. Along with the aim of stable prices and low unemployment, the Fed is now responsible for financial stability.

“Innovation and risk-taking contribute to the dynamism of our financial system and our economy. As Hyman Minsky emphasized, along with the many benefits of dynamism comes the reality that the financial system will sometimes evolve toward excess and dangerous imbalances … As laid out in our new Financial Stability Report, we have developed a framework to help us monitor risks to stability in our complex and rapidly evolving financial system.”

Martin Feldstein, the esteemed Harvard economist who is president emeritus of the National Bureau of Economic Research (which officially dates recessions) politely jumped all over this issue during Q&A. The notion the Fed can even identify mounting instabilities, let alone warn market participants or prevent them from cascading into market disruption, is utterly preposterous.

Third, Mr. Powell decided to make explicit comments, as his recent predecessors have, on the reasonableness of asset class prices today.

“We see no major asset class where valuations appear far in excess of standard benchmarks as some did, for example, in the late 1990s dot-com boom or the pre-crisis credit boom. The asset class that gets the most attention day-to-day is, of course, the stock market. Today, equity market prices are broadly consistent with historical benchmarks such as forward price-to-earnings ratios. It is important to distinguish between market volatility and events that threaten financial stability. Large, sustained declines in equity prices can put downward pressure on spending and confidence. From the financial stability perspective, however, today we do not see dangerous excesses in the stock market.”

The Fed has a terrible track record of making predictions. Seeing as their economic forecasts never come to fruition, when they enter the fray of market predictions you can imagine how they do. Just as Bernanke infamously called the impact of the housing collapse “contained” and considered a decline in home prices unimaginable, Powell will live to regret his unnecessary prognostications.

Some will say Powell was succumbing to political pressure. While there is an unmistakable political element to Fed actions, there is no President in our great history who didn’t want lower interest rates. Not one. Even before the Fed came about in 1913, this was true. The only difference this time is we have Twitter.

The market reaction to all this was not a surprise given the Fed’s orchestrated influence on market sentiment. But it is just a distraction, at this point. The focus for all investors should be on the ongoing slide in global economic growth. As Jim Grant of the Interest Rate Observer pointed out the other day, “GDP is not a predictor of GDP.” The Fed sideshow will take a backseat to reality soon enough.

MANAGING PARTNER | R.Christopher Wiegand, CFA®

“You might be on your way to financial freedom. We can help you get there. You might already be there. We can help you stay there. Help us throw the rules of thumb out the window and do what is prudent in the moment and not necessarily what everyone else is doing.”